Whenever you are making a real estate purchase or selling your property, there are many different documents that you may have to review and sign. One of those documents is called a seller net sheet. A seller’s net sheet, also known as a net sheet for short, helps sellers understand how much they’ll make from a real estate transaction. In most markets, a seller can expect to pay up to about 10% of the sales price in closing costs.

These fees go to all of the parties involved in the transaction – title company, title insurance costs, attorney fees, mortgage fees, transfer taxes, survey fees, inspection fees, and more.

This document is often confused with an ALTA Settlement Statement, its precursor the HUD-1 Statement, Good Faith Estimate, and/or the newer Closing Disclosure. A net sheet is similar but actually different than all of these.

Although it is formatted in a similar way to some of these closing documents, a seller net sheet is NOT the same thing and serves a different purpose.

In this post, we’ll outline what a seller net sheet is, who it is for, some differences between it and other documents, and when you should use it.

What is a seller net sheet?

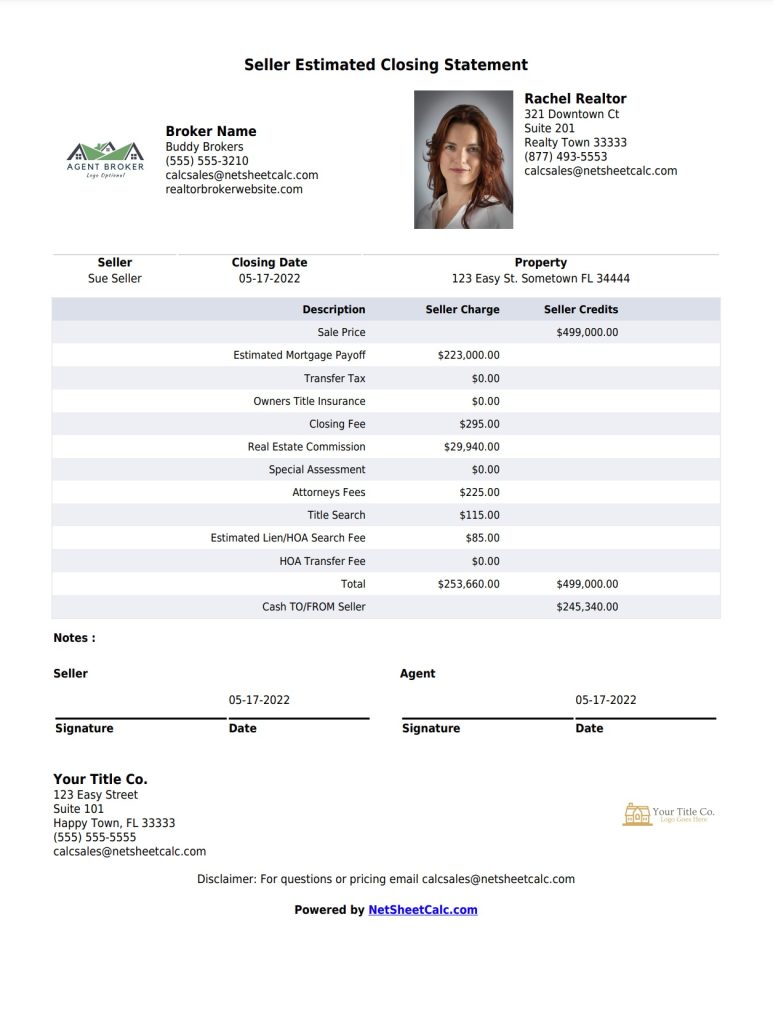

In short, a seller net sheet is a 1 to 2-page document which outlines the offer price of the home or property and estimates the expenses of selling the property in an itemized. The document shows the amount that the seller with “net” from the sale of the home – since many expenses of selling a property come directly from the profit of a sale.

A net sheet is ONLY an approximation: The exact numbers are not known until we get the final ALTA Settlement Statement and Closing Disclosure approximately 3 days before closing (under TRID rules), but it’s intended to be a close estimate.

Example of a Seller Net Sheet

What is the purpose of a seller net sheet and who is it intended for?

The main purpose of a seller net sheet is to show a seller of a piece of property approximately what they will make from the sale of their property.

Title insurance agents, escrow companies, abstracting services, and some real estate attorneys offer a net sheet as a tool for their real estate agents and staff to generate quotes for customers that estimate the approximate closing costs for buyers and sellers.

It is typically prepared by a real estate agent.

Why use a net sheet when it is only an estimate?

The main closing documents such as an ALTA statement and the Closing Disclosure only become available near the closing date. A seller’s net sheet is better earlier in the process, even before a property is listed to estimate the total proceeds to the seller, and even how much a buyer might expect to pay in order to buy a property.

Another advantage of the seller net sheet is that many real estate agents don’t know all of the details and fees that may have to be charged to the buyer or seller at closing time.

These are things like title insurance endorsements or special fees paid to rectify issues found on a property.

As such, a net sheet is a fantastic tool for Realtors and title company staff to generate quick title insurance quotes.

What numbers typically show up in a seller net sheet?

The nice thing about a seller net sheet is that it can be as detailed as you’d like it to be. It can contain many of the same items you’d find on an ALTA Statement but will differ between states.

For example, in Florida there is a charge for a specific form called an FF9 or Florida Form 9, for long. Whereas in Alabama, “Deed Transfer Tax” is simply known as “Deed Tax.”

Regardless, here are a few common fees that typically show up on a seller net sheet but there certainly can be more:

- Sale Price – Sale price of the home.

- Mortgage Balance – Balance of any current mortgages on the property.

- Closing Fee – This is the title or escrow company’s charge.

- Title & Search Fee – This is the fee for performing the title work.

- Owner’s Title Premium – This charge protects the buyer from any title defects.

- Loan Title Premium – Similar to the owner’s policy but for the lender’s protection.

- Survey Fee – Fee for the survey work done on the property which is required by lenders.

- Deed Transfer Tax – Cost to transfer ownership of the property.

- Recording Fees – Cost to your local government to record the transaction.

- Agent Commissions – The commissions paid to any real estate agents in the process.

View the different title insurance costs or common items found on a net sheet in your state.

Am I required to get a net sheet?

In short, no. Net sheets are completely optional but many real estate agents and title companies find them useful since sellers are often curious as to what they will make financially by selling their property.

Likewise, if what you owe on a mortgage is close to what the fair market value of the property then it may be a good idea to request a net sheet to ensure that the proceeds after expenses will payoff the existing mortgage. Otherwise you may actually owe money when you sell, which would not be a good thing.

These days, most savvy real estate agents and title companies have access to a net sheet calculator to provide these estimates quickly and easily.

What if I’m a buyer, not a seller, can you estimate my costs?

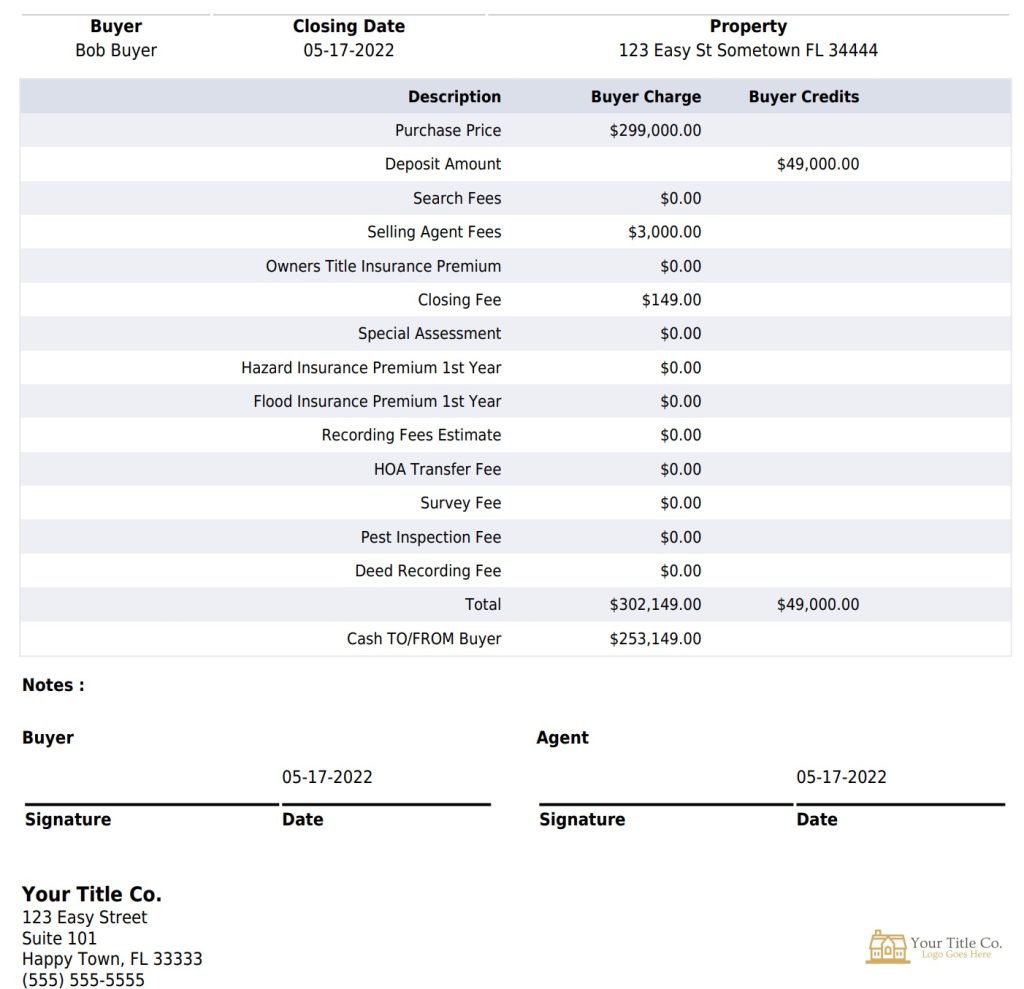

Actually yes! There is a similar tool called a buyer cost calculator, which is essentially the same thing as a seller net sheet but outlines the buyer’s cost to buy the property instead of the seller proceeds.

These days, most popular title insurance calculators offer a tool for both the buyer, seller, and even refinance calculators in many instances.

Here is an example of a buyer cost calculator estimate. As you can see it is very similar to a seller net sheet except that it shows the buyer charges and credits as these are the numbers that are important to the buyer and listed from their perspective on what they would owe to purchase a property.

Buyer Cost Calculator Estimate – Cash

What if the property has multiple offers?

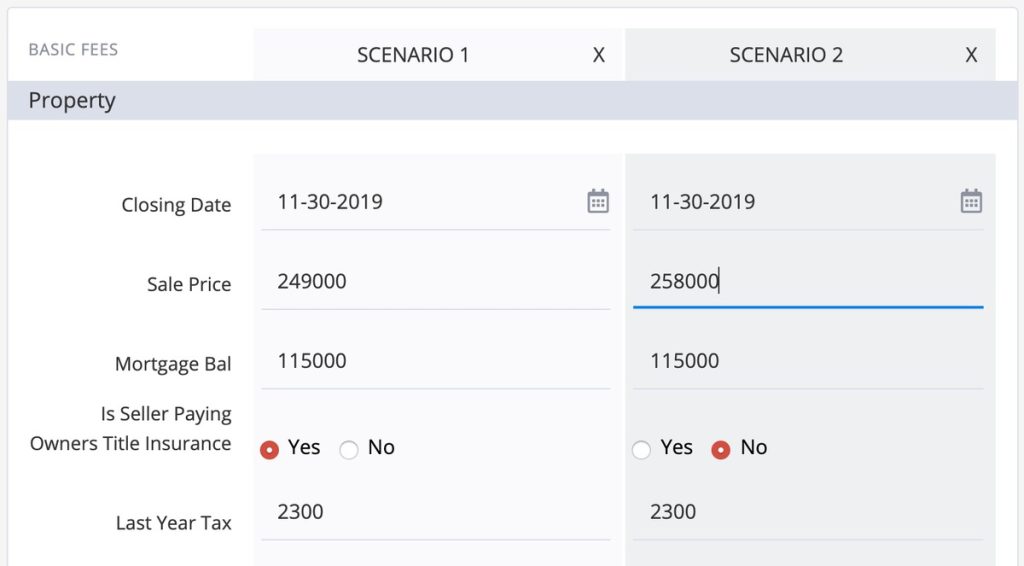

For most net sheet calculators, you’d need to create a different net sheet for every offer but with net sheet calc, you can actually see up to 3 offers side-by-side.

This is super useful when there are multiple offers on a property.

Example of a Net Sheet with Multiple Offers on a Property

As a real estate agent, when are the best times to generate a net sheet?

Most real estate agents agree that the best times to generate a net sheet are as follows:

- Before listing a property – Sometimes people are not sure if they want to list their home until they see what they could make by selling it.

- During a listing appointment – When listing a property, the seller will probably have a target amount they would like to sell the property for. This is a great time to work up a net sheet.

- When presenting an offer to a FSBO seller – FSBO is simply an acronym “for sale by owner.” It means that the seller put it on the market themselves without the help of a real estate agent.

- When representing the buyer – But if you are representing the buyer, presenting a net sheet with the offer is a great way to motivate the seller to say yes.

- When presenting offers to your seller – Again, when they see how much they would pocket with an actual buyer offer, it makes the process more real for them.

If you are a real estate agent and are not using a net sheet as part of your sales process, you should be. It is a quick and easy way for you to close more sales faster. Contact your local title company or law firm and ask if they have one available for you to use.

If you are a real estate law firm, title insurance company, settlement, or escrow service and are not offering a net sheet, watch a quick demo here to see if it is right for you and your customers.