The home buying process can be both an exciting and overwhelming process if you haven’t gone through it before. Throughout the closing process, you’ll be given many forms to review and sign so it is important to understand what you are looking at. One of those real estate closing documents is known as an ALTA Settlement Statement or ALTA Statement for short.

This post is a comprehensive guide to ALTA Settlement Statements. We’ll cover everything you need to know about it.

Table of Contents

- What is a Settlement Statement?

- Is a HUD-1 the same thing as an ALTA settlement statement?

- What does ALTA stand for in real estate?

- Who provides the ALTA statement?

- Is an ALTA settlement statement required?

- What are the different types of ALTA Settlement Statements?

- Do you have an example PDF of an ALTA statement?

- How to read an ALTA settlement statement?

- Sections of an ALTA settlement statement

- Section 1: Headings

- Section 2: Financial

- Section 3: Prorations/Adjustments

- Section 4: Loan Charges to Lender

- Section 5: Other Loan Charges

- Section 6: Impounds

- Section 7: Title Charges & Escrow / Settlement Charges

- Section 8: Commission

- Section 9: Government Recording and Transfer Charges

- Section 10: Payoffs

- Section 11: Miscellaneous

- Section 12: Subtotals/Totals

- Section 13: Acknowledgement

What is a Settlement Statement?

A settlement Statement is a standardized document that a buyer gets at a real estate closing that summarizes the terms and conditions of a loan, plus lists all charges and credits to the buyer and to the seller in a real estate settlement.

It is also used in a mortgage refinance to list all the charges.

Other common names for it are ALTA statements or a closing statement, but not to be confused with a closing disclosure or a seller net sheet.

HUD-1 Settlement Statement was similar but is no longer used in that form.

According to a post on ALTA’s website:

“ALTA created model Settlement Statements based on the settlement statements that are used today in conjunction with the HUD-1. These Settlement Statements are intended to provide uniformity to the marketplace and may be used alongside the Closing Disclosure to help the industry meet its legal and regulatory obligations. If a Settlement Statement is used, the totals must match the Closing Disclosure.”

Is a HUD-1 the same thing as an ALTA settlement statement?

They are not exactly the same thing but serve the same purpose – which is to disclose all of the details of your purchase including charges and credits.

HUD-1 was also often mistaken as the same thing as a Good Faith Estimate (GFE).

New regulations put forth by The Consumer Financial Protection Bureau (CFPB), The Real Estate Settlement Procedures Act (RESPA), and specifically The Truth in Lending Act (TILA) created a set of similar documents to make the process easier for consumers to understand.

If you got your mortgage prior to October 2015, you received a HUD-1 statement. If you got a mortgage after that date, you likely received an ALTA Settlement Statement.

What does ALTA stand for in real estate?

ALTA is simply the acronym for American Land Title Association, which is basically the national associate for title insurance companies, escrow companies, abstract companies, and settlement services – depending on where you are located in the United States.

ALTA is the organization that provides the ALTA statement and helps title agents adhere to new regulations.

Who provides the ALTA statement?

A settlement statement is typically provided to the homebuyer and a seller by the company you are working with to close your real estate transaction.

Most often be provided to by the mortgage lender, settlement agent, abstract company, title and escrow company, or a real estate attorney – depending on where you live.

Where closing disclosure is exclusively used by the buyer (or borrower for transactions that involve a mortgage), an ALTA settlement state is given to both the agents, brokers and consumers on both sides of the transaction. It’s almost like a receipt that both parties acknowledge during the real estate closing process.

Is an ALTA settlement statement required?

It depends on what type of purchase is being made.

ALTA statements aren’t required by law for all transactions but are meant to be used with the Closing Disclosure that both buyers and sellers are required to receive per the Consumer Financial Protection Bureau (CFPB).

A settlement statement is required anytime a mortgage loan will be taken out on a property. This includes purchases, refinances, and commercial purchases alike.

ALTA Settlement Statements allow title and escrow companies or real estate attorneys alike to itemize all the fees and charges that both the homebuyer and seller face during the process of purchasing a home or a piece of property.

Since fees and local title insurance customs differ between regions, they were designed to be modified and expanded to allow agents to list any fees that may be applicable in their state or county, in addition to the national fees.

What are the different types of ALTA Settlement Statements?

There are 4 different types of ALTA Statements for different types of transactions:

- Combined ALTA Settlement Statement – The combined ALTA settlement bundles together all transactions as they apply to both the buyer and/or the seller.

- ALTA Settlement Statement Cash – This is the version used for cash transactions for property purchases.

- Settlement Statement – This is the version used specifically for the buyers in the real estate purchase and contains only information pertinent to the buyer’s side of the transaction.

- Seller’s Closing Statement – This version of the ALTA Statement lists mostly the credits given to the seller and any fees extracted from the net proceeds that will impact the amount of cash the seller receives. It is the most similar document to but not the same as a seller net sheet.

Do you have an example PDF of an ALTA statement?

Yes, below are PDFs of ALTA Settlement Statements used for the 4 different types of documents:

ALTA Settlement Statement Borrower-Buyer

ALTA Settlement Statement Cash

ALTA Settlement Statement Combined

ALTA Settlement Statement Seller

How to read an ALTA settlement statement?

At first glance, an ALTA statement may seem overwhelming. However, once you read through the details of each line item, many people find most of the items straightforward.

Here is a list of common items listed on a settlement statement:

- Total loan amount

- Your interest rate and terms

- The home’s contract price

- Real estate taxes

- Real estate agent commissions

- Title and/or escrow fees

- Lender fees – this includes loan origination, underwriting, and discount points

- Any home inspection fee

- Any appraisal fees

- The private mortgage insurance premium is also known as PMI (if applicable)

- Homeowners insurance premium

- Title insurance policy premium

- Notary fee

- Other closing costs, such as title insurance fees, attorneys, deed transfer, recording fees, transfer taxes or conveyance fees. Many of these depend on the location of the property.

- Homeowners association fees (if applicable)

Sections of an ALTA settlement statement

Including the headers and depending on how you count them, there are approximately 13 sections in the Combined ALTA Settlement Statement. We’ll review each section in detail below.

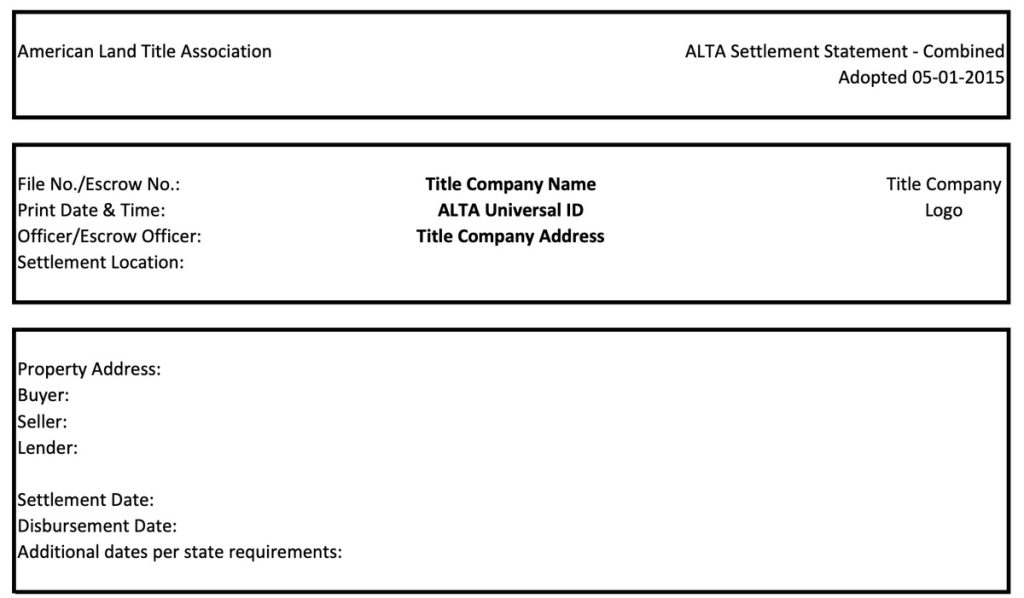

Section 1: Headings

This section just tells you what the statement is, give your file number and escrow officer you worked with and lists important information about the property and transaction such as the address, buyer, seller, and lender.

The Heading Section of an ALTA Settlement Statement

- Title Company Name and Logo – This is a great document to reference if you ever go to refinance as you may be able to get a credit on the title insurance premium itself if you call this title company.

- File/Escrow No. – This is just the internal number that your closing agent uses to reference your file. Most buyers and sellers don’t need to know this number.

- Escrow Officer – This is the main person at the title, escrow, or abstract company or law firm who worked on your closing.

- Settlement Location – The location of the closing.

- Address – Address of the property being sold.

- Buyer/Seller – The buyer and seller names.

- Lender – The bank or mortgage company affiliated with the transaction.

- Settlement Date – Date of the closing.

- Disbursement Date – Date where any funds in the escrow account will be disbursed to the parties involved including the seller, real estate agent commissions, and title agent fees.

- Additional Dates per state requirements – Some states require other dates to be listed. This is one of the benefits of an ALTA statement over other types of closing documents such as a closing disclosure.

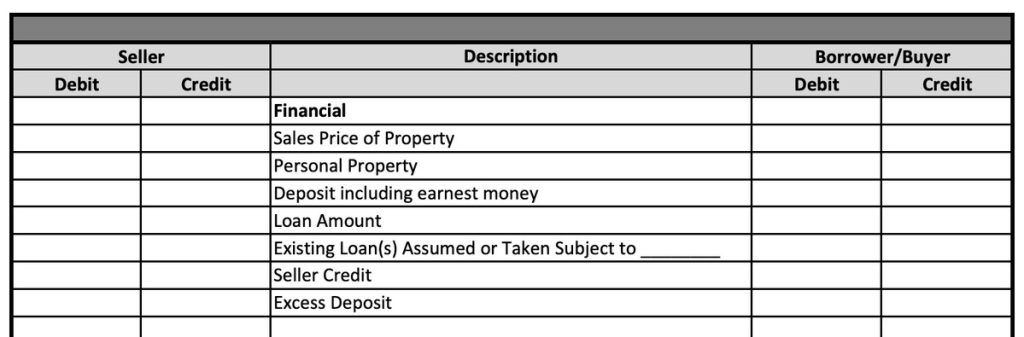

Section 2: Financial

The financial section of the ALTA statement is the first on the table part of the document. It outlines the major dollar amounts such as the sale price and loan amount.

From these primary numbers, credits, and debits are made to pay for the settlement services and pay the parties involved with the transaction.

The Financial Section of an ALTA Settlement Statement

The fees in this section are as follows:

- Sale Price of Property – This is pretty self-explanatory. It is the total price of the property that seller and buyer have agreed on before any credits or fees have been paid.

- Personal Property – These are paid by the buyer of the property if they agree to purchase any personal property items such as furniture, appliances, boats, etc.

- Deposit including earnest money – Earnest money is simply the deposit you make initially when putting an offer on a property. It counts towards your full deposit and purchase price.

- Loan Amount – This is the amount the bank or mortgage company is lending to aid in the purchase.

- Existing Loans Assumed or Taken Subject to – If the buyer has agreed to take over the existing mortgage from the seller, the dollar amount will be listed here.

- Seller Credit – Any credits that the seller will receive as a result of any negotiations.

- Excess Deposit – Any additional deposits that the buyer has agreed to pay.

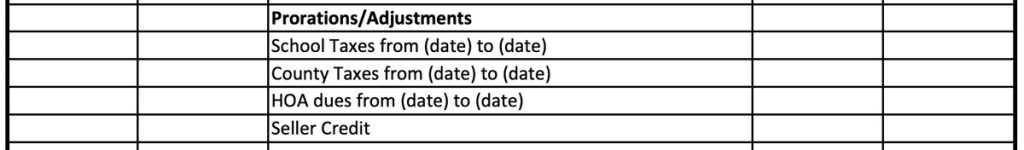

Section 3: Prorations/Adjustments

The prorations/adjustments section includes adjustments based on the local customs and regulations for things like property taxes and HOA dues.

For instance, in Florida property taxes are per diem, which just means that you take the total property tax you would pay for the year and divide it up by 365 days. You get your per-day tax.

The proration for this tax would be the day that you close. For example, if the closing date was on January 2nd, the seller would pay 2 days of taxes, and the buyer would have to pay 363 days’ worth of taxes since this is how long each of the parties owned the property.

The Proration/Adjustments Section of an ALTA Settlement Statement

Here is a breakdown of the items in this section:

- School taxes – If any school taxes are due, the prorated amount would show up here. Again, this is specific to the location of the property and isn’t always listed in every property location.

- County taxes – Any county prorated taxes will show up here.

- HOA dues – If the property is part of a homeowners association (HOA) or property owners association (POA) then it would be listed here.

- Seller Credit – If the buyer and seller have agreed on specific credits such as a price reduction to replace or repair something that was found broken on inspection, then that amount would be listed here.

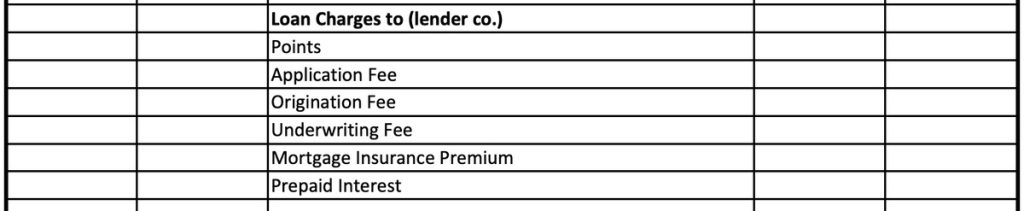

Section 4: Loan Charges to Lender

The amounts listed in this section are typically paid to the lender. There are many people on the lending side involved with your transaction. Many of these go towards those services. Whether paid for by the buyer or seller, they will show up in the debit column for each.

The Loan Charges Section of an ALTA Settlement Statement

Below are the mainline items in the Loan Charges section of the ALTA Statement:

- Points – With mortgage points, a lender can reduce the buyers’ interest rate. Buyers typically purchase these prior to closing. The cost is something upfront but can reduce your overall, long-term cost of the property by reducing the interest rate you actually pay.

- Application Fee – This is the fee charged by the lender in order to review and process your mortgage application.

- Origination Fee – This is the fee that the lender charges when they create an account at the lending institution or bank when they process the mortgage.

- Underwriting Fee – Underwriting is the process by which the bank reviews your application to make sure that you can afford the property and mortgage you are applying for. This is the fee charged for that. Typically this is paid for by the buyer/borrower.

- Mortgage Insurance Premium – This is also known as PMI and is only required if the buyer is putting less than 20% of the purchase price as a down payment in cash. This ensures your mortgage if property values were to lower drastically. It typically gets tacked on to your overall purchase price.

- Prepaid Interest – This is the dollar amount calculated between the closing date and the time of your first mortgage payment. For instance, if you closed on the 15th of the month, there may be 15 days before your first mortgage payment is due (on the 1st day of the following month).

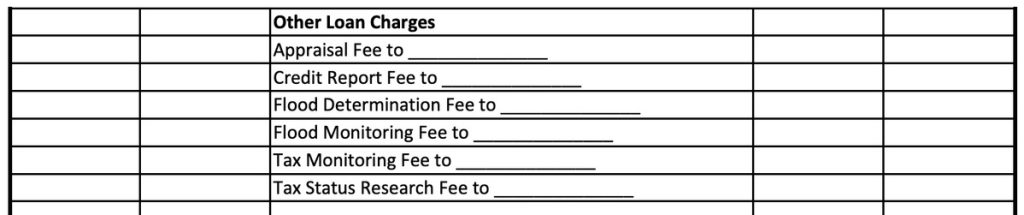

Section 5: Other Loan Charges

There are many different parties involved in most real estate transactions including the title or escrow company, sometimes a real estate law firm, buyer and seller real estate agents, appraisers, inspectors, a lender, and a bank, just to name a few.

The Other Loan Section of an ALTA Settlement Statement

Here is a list of some of the other loan charges that need to be paid to other third parties:

- Appraisal Fee – Paid to an appraisal company that determines the value of the property for sale.

- Credit Report Fee – Credit reports cost money. That fee is passed through to you as the buyer.

- Flood Determination Fee – In coastal areas or areas prone to flooding this fee may be charged so that the mortgage company can ensure that a flood isn’t likely.

- Flood Monitoring Fee – Similar to the above but a fee charged for continuous monitoring of flood conditions.

- Tax Monitoring Fee – Paid to a company that checks on pending taxes. Passed through to the buyer.

- Tax Status Research Fee – Fee paid for checking for late payments to a lender.

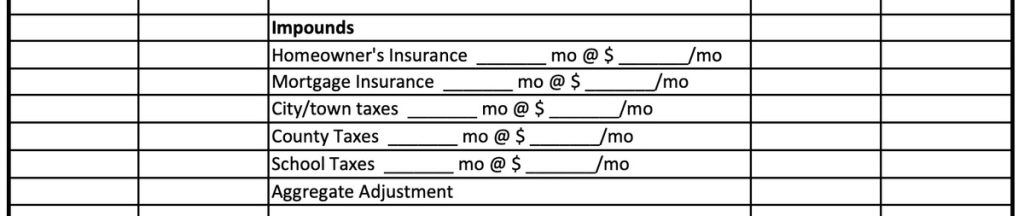

Section 6: Impounds

The impounds section simply breaks down the different charges for purchasing the property in that location broken down by months and dollar amount per month.

The Impounds Section of an ALTA Settlement Statement

- Homeowner’s Insurance – If you have a mortgage you are required to carry this but even if your mortgage is paid off it is always a good idea to have.

- Mortgage Insurance – This is required if you have a mortgage.

- City/town Taxes – Sometimes required per the city or town.

- County Taxes – Sometimes required per the county.

- School Taxes – Sometimes required per the school district.

- Aggregate Adjustment – Some of these can fluctuate between years or with new regulations. This is a calculation that prevents the lender from collecting too much money from the buyer that which is allowed by the Truth In Lending Act (TILA) and the Real Estate Statement and Procedures Act (RESPA). By this standard, they can hold no more than 1/6th of a homeowner’s insurance and property taxes.

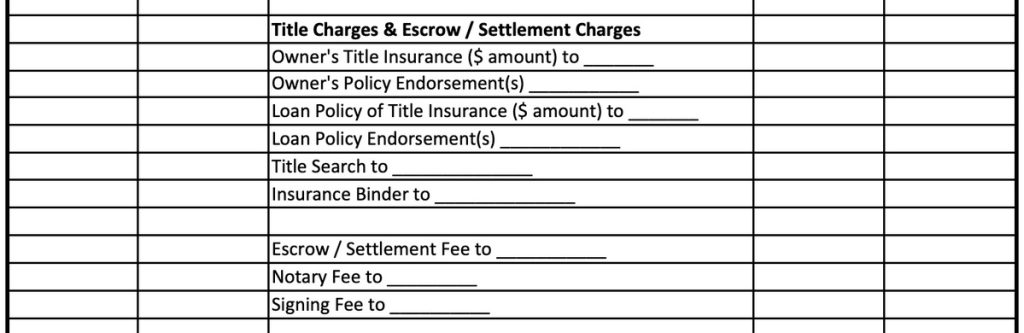

Section 7: Title Charges & Escrow / Settlement Charges

This section contains any fees that the title and escrow company, settlement or abstract company, or real estate law firm charges to prepare and coordinate the closing.

The Title Charges & Escrow / Settlement Section of an ALTA Settlement Statement

- Owner’s Title Insurance – An Owner’s Title policy buys the purchaser peace of mind that they actually own the property. It isn’t required but is always a good idea when making such a substantial purchase.

- Owner’s Policy Endorsement(s) – Endorsements vary based on the location of the property. These are just additional charges for specific things that may be required or optional in certain markets.

- Loan Policy of Title Insurance – This is the same thing as a Lender’s Title Insurance Policy. It is similar to the “Owner’s” version above but protects the lender from the same thing.

- Loan Policy Endorsement(s) – Similar to the Owner’s Policy Endorsements. Endorsements vary based on the location of the property.

- Title Search – This is one of the services that a title company performs prior to issuing title insurance. The cost is passed through to you.

- Escrow / Settlement Fee – This is the fee the title, escrow, or settlement company charges for their services.

- Notary Fee – As with most legal documents, they require a notary to witness the signing. Real estate transactions are no different. This fee is passed through to you.

- Signing Fee – This is an additional fee paid to the notary for actually signing for facilitating.

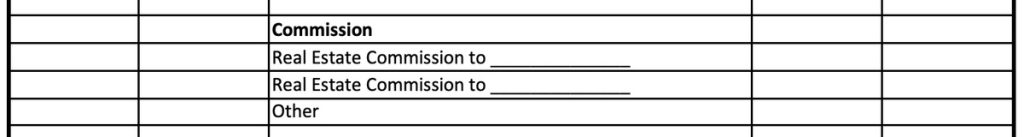

Section 8: Commission

This section is pretty straightforward as it simply outlines the commissions being paid to the real estate agents who were involved in the transaction. This is usually a buyer’s agent, who represents the buyer, and a seller’s agent who represents the seller.

The standard percentage is usually 4-6% total but can be negotiated and gets split between both agents.

The Commission Section of an ALTA Settlement Statement

Keep in mind that every real estate agent must be affiliated with a brokerage firm that also deducts their fees from their agent’s commission.

- Real Estate Commission to Buyer’s Agent – This is the commission paid to the buyer’s real estate agent if they have one.

- Real Estate Commission to Seller’s Agent – This is the commission paid to the listing real estate agent if they have one.

- Other – Any other commissions that need to be paid.

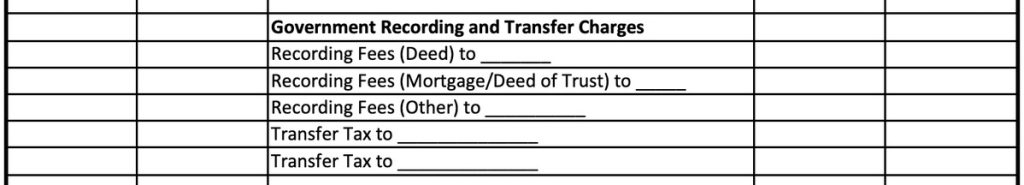

Section 9: Government Recording and Transfer Charges

These are fees required by the government (often state or local) for recording and transferring ownership to a new party. As with the other fees on this document, they are pass-through to the buyer and seller.

Sometimes it is customary for the buyer to pay these, other times it is the seller’s responsibility, and yet other times these are negotiable. Review title insurance costs by state to understand what your options are and what your local market calls each of these as it can differ slightly between states.

The Government Recording & Transfer Section of an ALTA Settlement Statement

- Recording Fees (Deed) – A Recording Fee as part of the closing costs in a real estate transaction that the local government charges when a property transfers ownership. Many states have what is called a deed transfer tax if you buy or sell a home. This deed transfer tax is usually calculated based on a formula determined by your state and the fair market value of the home. The tax goes directly to the state to help support the state, county, and city operations.

- Recording Fees (Mortgage/Deed of Trust) – Whenever you get a mortgage for a home loan several state governments often require what is called a mortgage tax or mortgage recording tax.

- Recording Fees – Recording fees will differ between states and counties depending on how complex a transaction is. For instance, you might expect to pay more if there are more documents you are required to file versus fewer documents.

- Transfer Tax – Similar to the items above but any other transfer taxes that are required.

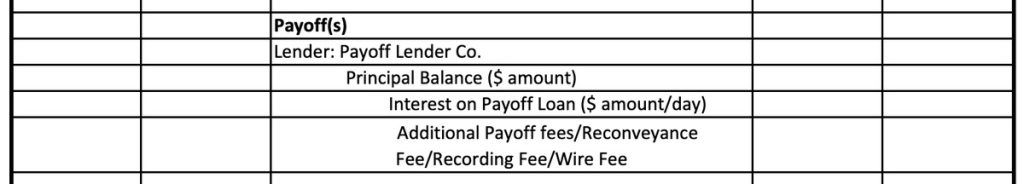

Section 10: Payoffs

In many real estate purchases, the seller has an existing mortgage. This section is all about the seller paying off existing loans from the proceeds of the sale.

The Payoff Section of an ALTA Settlement Statement

- Lender – This is where the current lender/company name is listed.

- Principal Balance ($ amount) – This is the current mortgage balance on the property.

- Interest on Payoff Loan ($ amount/day) – The per diem outstanding interest that the seller owes on the current loan.

- Additional Payoff fees/Reconveyance Fee/Recording Fee/Wire Fee – These are some common additional fees connected to the recording, wire, or payoff fees.

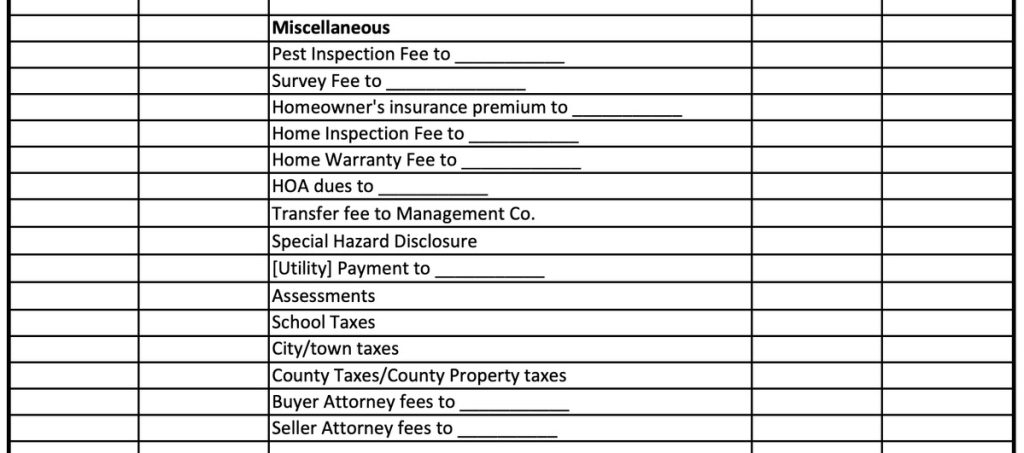

Section 11: Miscellaneous

The miscellaneous section as part of the ALTA Settlement document is basically where any other fees are listed to any party involved in the transaction.

The Miscellaneous Section of an ALTA Settlement Statement

Not all of these will be relevant for every purchase. Flexibility is one of the benefits of the ALTA statement.

- Pest Inspection Fee – This fee may be listed if the property has any pest infestation found in the inspection period that needed to be resolved prior to the closing.

- Survey Fee – The dollar amount owed to the survey company to survey the property for the owner or bank.

- Homeowner’s insurance premium – Most homeowners are required to carry insurance. That cost is listed here.

- Home Inspection Fee – When purchasing a home, it is a good idea to get a home inspection. Their fees go here.

- Home Warranty Fee – If you purchased a warranty or for a repair/replacement, the fee would go here.

- HOA Dues – Homeowner’s associations typically require their dues to be paid prior to transferring a title.

- Transfer fee to Management Co. – The fee to transfer to a management company if applicable.

- Special Hazard Disclosure – If there are special hazards found on the property, there may be special fees listed here.

- Utility Payment – Pending utility bills for things like phone, cable, trash, or electricity.

- Assessments – Any assessment charges paid during the time of closing.

- School Taxes – Some local governments require taxes that go to local schools.

- City/town taxes – Many cities have specific taxes paid to them on property sold.

- County Taxes/County Property taxes – Many counties have taxes once a property is sold.

- Buyer Attorney fees – Any attorney fees that are paid by the buyer.

- Seller Attorney fees – Any attorney fees that are paid by the seller.

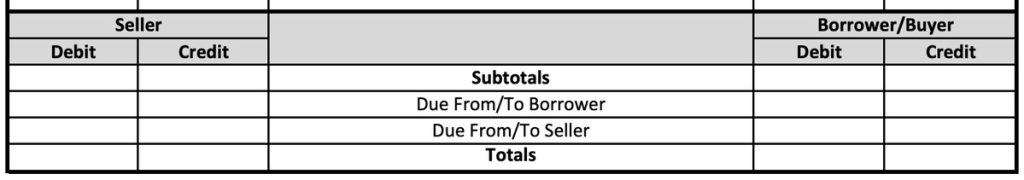

Section 12: Subtotals/Totals

The totals section includes all of the subtotals of any debits and credits by both the buyer and the seller and a grand total for both parties – how much the buyer owes and how much the seller gets.

The Totals/Subtotals Section of an ALTA Settlement Statement

- Due From/To Borrower – How much the buyer owes.

- Due From/To Seller – How much the seller gets.

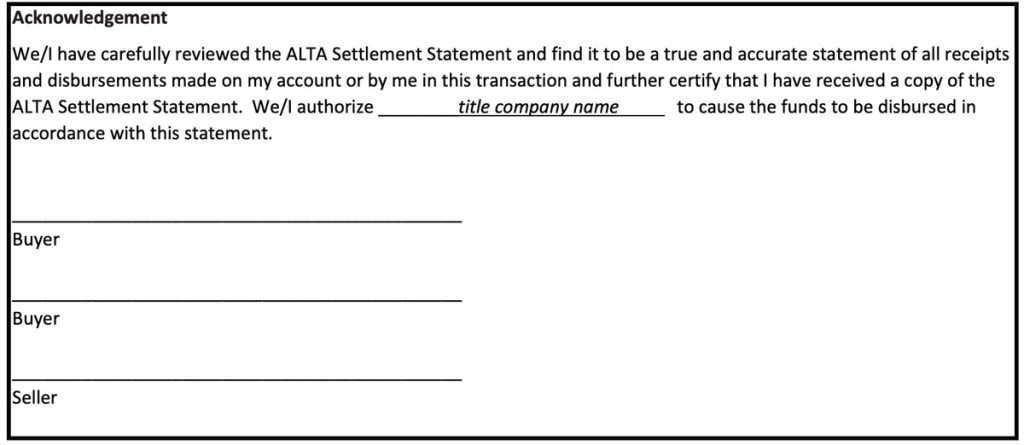

Section 13: Acknowledgement

This section just allows the buyer, seller, and escrow officer to sign off that they agree with the charges and fees.

The Acknowledgement Section of an ALTA Settlement Statement

In closing

As mentioned above, the ALTA Settlement Statement may seem overwhelming at first. But once you understand how many people are involved with the transaction and how much work goes into it, it is easy to see why there are so many items listed.

The benefit of an ALTA Statement is that it is flexible – line items can be added and removed at will for your local market. The template just lists the most common items that could show up.

Looking for a tool that estimates seller net proceeds and buyer costs for real estate deals? Watch a quick demo to see if Net Sheet is right for you.