Wyoming Net Sheet Calculator

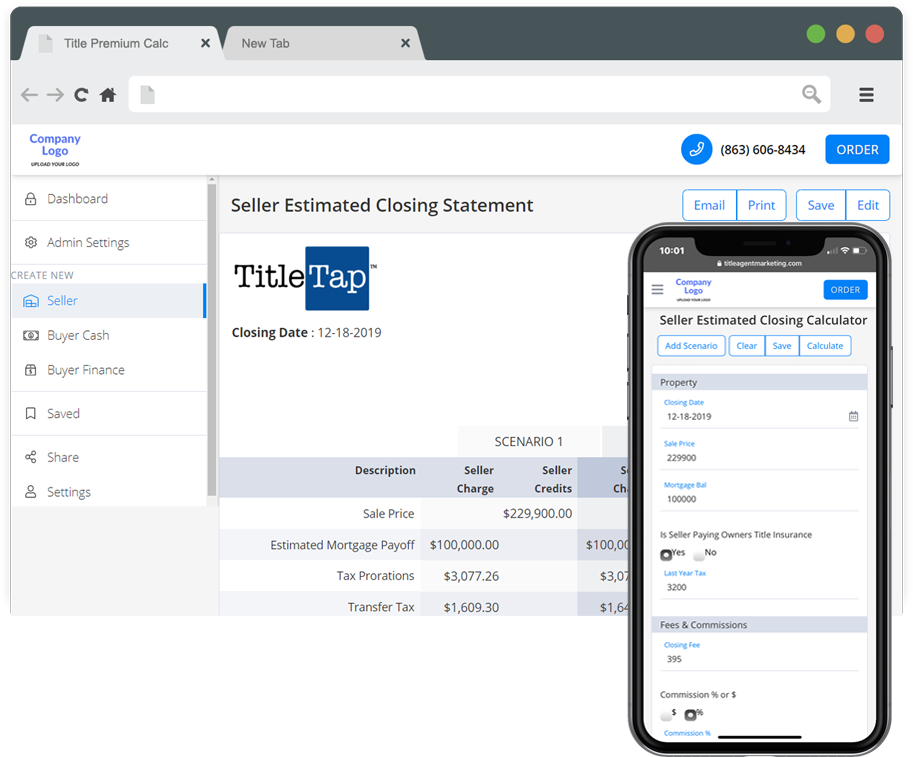

Title Insurance Rate Calculators: Seller Net Sheet, Buyer Finance, Buyer Cash, Title Insurance Premium, and Refinance Options

Standard Features

Buyer & Seller Net Sheet

Side-By-Side Scenario

Co-Brand with Customers

Refinance Calculator

Title Premium Calculator

Save, Edit, Share & Order

Common Wyoming Net Sheet Calculator Customizations

Filed Rate State

Deed Transfer Tax

Mortgage Transfer Tax

Owner’s Title Insurance

Lender’s Title Insurance

Title Search & Exam Fees

Survey Fee

Closing Fees

Recording Fees

Recording Fees

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What are the average price of a house in Wyoming?

According to a recent report by ClosingCorp the average sale price of a home in Wyoming was $318,767.

What are the average closing costs for a residential house in Wyoming?

According to a recent report by ClosingCorp the average closing cost of a home in Wyoming was $2,572.39.

What is the easiest way to calculate the title insurance rates and estimated closing costs for a house in Wyoming?

If you are an title company, escrow company, abstracting company, or a real estate attorney, you can get a branded title insurance calculator with multiple outputs available including a seller net sheet, buyer finance calculator, buyer cash calculator, and a refinance calculator.

Access to this net sheet calculator can be provided to your real estate agents or marketing representatives, and shared with your buyers and sellers to help you close more real estate deals faster.

How are title insurance rates determined in Wyoming?

Every state has different regulations regarding how title insurance rates are set in that state. States like Florida and Texas are known as promulgated rate states because their fees are standarized across the state. However, in most states the rates are what is known as filed rates. Every state has different regulations regarding how title insurance rates are set in that state. States like Florida and Texas are known as promulgated rate states because their fees are standarized across the state. However, in most states the rates are what is known as filed rates. Like the majority of states, Wyoming’s title insurance rates are filed. But in filed rate states, the actual rates will differ between underwriters.

Who can handle a closing in Wyoming?

In addition to the rates themselves, each state also has different laws regarding who can actually handle real estate closings. For example, some states are mostly title companies, others are title and escrow, and yet others are attorney-only states or even a mix of the above.

Real estate transactions in the state of Wyoming are by a title company.

Is there deed transfer tax in Wyoming?

Many states have what is called a deed transfer tax if you buy or sell a home. This deed transfer tax is usually calculated based on a formula determined by your state and the fair market value of the home. The tax goes directly to the state to help support the state, county, and city operations.

In Wyoming there is no deed transfer tax.

Is there a mortgage tax in Wyoming?

No, there is no mortgage tax in Wyoming. Whenever you get a mortgage for a home loan several state governments often require what is called a mortgage tax or mortgage recording tax. Currently there are only 7 states that charge mortgage recording taxes. These states are: Wyoming, Florida, Kansas, Minnesota, New York, Oklahoma and Wyoming.

Who pays the Owner’s Title Insurance Policy Premium in Wyoming?

An Owner’s Title Insurance Policy is simply the insurance purchased when you buy or sell a home to protect you if an issue is found with the property’s history. In real estate, liens often follow the property and not necessarily the person who previously owned the property at that time. Title insurance is simply buys you piece of mind on what is typically your largest investment.

In the sale of any real estate, someone has to pay for this insurance. This differs in different states and even sometimes between counties.

For instance, in Wyoming, the Owner’s Title Insurance Policy is paid by the seller. This is customary in most states.

Who pays the Lender’s Title Insurance Policy Premium in Wyoming?

The Lender’s Title Insurance Policy is similar to the Owner’s Title Policy except that it protects the lender or the bank from any issues with a property instead of the property owner. A good rule of thumb is that a Lender’s Title Insurance Policy is required anytime there will be a loan attached to a property. Whereas in an “all cash” real estate transaction, there would be no need for a lender’s policy as there is no loan to insure. This is also known as a Loan Policy.

In Wyoming, the Lender’s Title Insurance Policy is typically paid for by the Buyer.

Who pays Title Search & Exam Fees in Wyoming?

Most title, escrow, and abstracting companies and real estate attorneys charge what is called a Title Search & Exam Fee. This fee simply pays for the time and effort for someone to validate the true owner of the property. Sometimes this is negotiable and yet other times it is simply included in the title premium for that state or underwriter.

In Wyoming the Title Search and Exam is included in the premium.

Who pays for the Survey Fee in Wyoming?

When buying a property, it is often required to what is called a Survey. This cost is passed through to the buyer or seller in what is called a Survey Fee.

When closing on a piece of real estate in Wyoming the Survey Fees can be paid by either the buyer or the seller and therefore are negotiable.

Who pays the Closing Fees in Wyoming?

Closing fees are one of fees a title company, title and escrow company, abstracting company, or a real estate law firm charges to actually conduct your real estate closing. These can vary from company to company.

In Wyoming, the closing fees are divided equally unless there is an out of state lender, in which case the buyer pays an additional “loan” closing fee.

Who pays for the Recording Fees in Wyoming?

Most states and counties have what is called a Recording Fee as part of the closing costs in a real estate transaction that the local government charges when a property transfers ownership. Recording fees will differ between states and counties and depending on how complex a transaction is. For instance, you might expect to pay more if there are more documents you are required to file verses less documents.

In Wyoming the buyer pays to record deed and mortgage; Seller pays to record documents to remove encumbrances.

Want your own closing cost calculator for Wyoming?

To request a quote or questions, contact us below.